welcome

about action

action in 2021

SUSTAINABILITY

PEOPLE

planet

product

partnership

future

governance

appendices

Every day Action

‘Hajir is a significant part of the Action DNA. Action is ready for the next phase of its growth agenda with an increased focus on digital and sustainable growth, two areas for which Hajir is currently responsible.’ Simon Borrows, board chair

The way we manage our business is in line with our formula: simple and straightforward, with clear demarcations on what is done centrally and what is done within the country offices. At our international headquarters in Zwaagdijk (the Netherlands), a team of professionals works to support the ten country offices in the execution of our expansion strategy.

Our teams at the international headquarters develop and share expertise across different fields, including HR, IT, Legal, Finance, Marketing and Communications. Our buying team is active globally. Our country offices are primarily focused on store operations and support the stores with the acquisition and construction of new stores and HR services.

Action’s executive directors, our CEO and CFO, are responsible for the day-to-day management of the company and together form the Executive Board. They lead by example with respect to managing risk and ensuring compliance with laws, regulations and our internal policies. They are responsible for ensuring that effective internal control and risk management systems are in place. The Executive Board has established a Risk and Compliance Committee to oversee and monitor Action’s risk profile and associated risk management and compliance policies and processes. The Executive Board is assisted and supported in carrying out their duties and responsibilities by an executive committee consisting of 16 senior leaders responsible for the key functions in our company.

Over 80% of Action’s shares are owned by 3i Group plc and funds managed by 3i, a FTSE 100 firm with operations across Europe and North America. Action has a one-tier governance structure with a Board of Directors, consisting of our CEO and our CFO as executive directors and six non-executive directors. Our current non-executive directors are Simon Borrows (board chair), Menno Antal, Marc van Gelder, Robert van Goethem, Boris Kawohl, Sameer Narang and Ulrich Wolters. An Audit Committee and a Selection, Nomination and Remuneration Committee have been established as sub-committees of the board.

In November 2021, the Board of Directors announced that CEO Sander van der Laan would be succeeded by Hajir Hajji as of January 2022. Simon Borrows, Chairman stated that: “On behalf of the Board I want to recognise and thank Sander for successfully leading the company. Action has continued its strong growth despite the uncertainties presented by the pandemic. He leaves the business performing strongly and on track to deliver its business plan. He has been a driven and committed colleague.”

On Hajir’s appointment, Simon Borrows stated that: “Hajir is a strong leader and has great retail expertise, including on digital and sustainable growth. A longstanding Action executive and an advocate of the Action culture and values, she will bring both continuity and a new push for Action’s next phase of growth. I look forward to working with her.”

We monitor our internal control performance by means of internal control activities in the first line, risk and control self-assessments, risk management reviews, and internal audit activities. Dashboards are available for our business teams to allow for online real-time insight in control performance, for example, to monitor self-assessments or the quality of our data processing activities. Taking ownership of internal control and financial performance is formalised by means of our quarterly certification process in which a Letter of Representation is signed by management of selected Action entities.

Quarterly Risk Assurance reports are submitted to and discussed with our business teams, Executive Board, Risk and Compliance Committee and Audit Committee. These reports provide a comprehensive overview of internal control performance and help identifying our improvement potential.

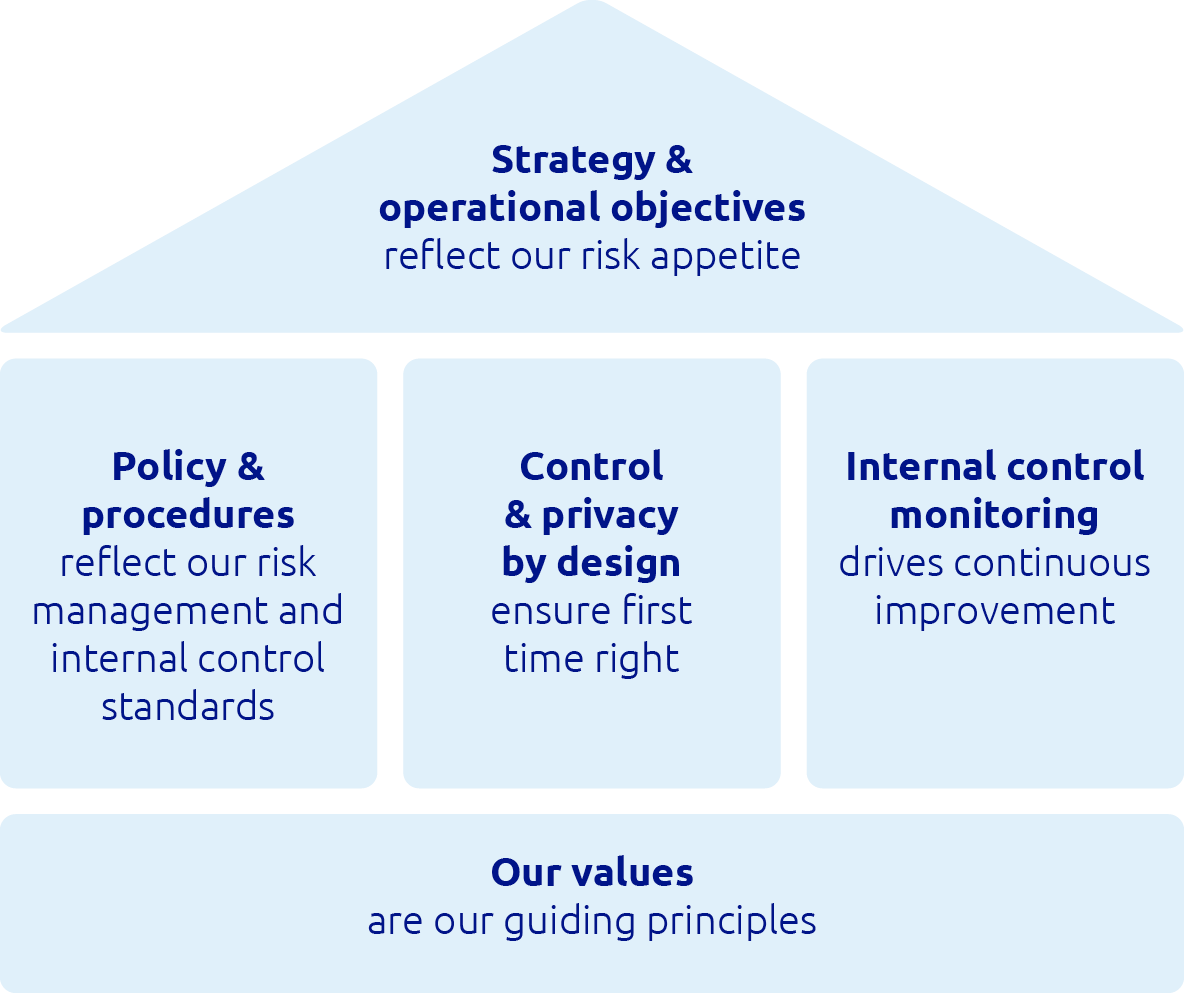

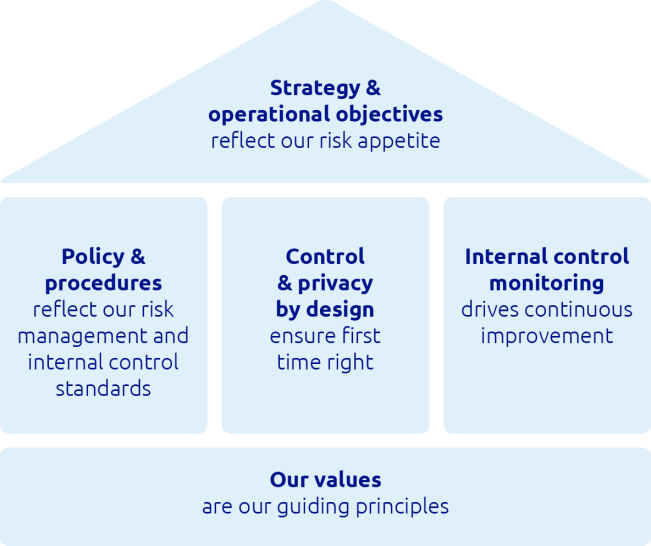

We strongly believe that managing risk in a professional manner is essential to achieving our strategic and operational objectives, while ensuring compliance with internal and external requirements. Our proactive approach to risk management, embedded in our processes, aims to protect and preserve long-term value.

Over the last six years we have implemented a formal risk management and internal control system, based on the COSO Internal Control Framework. Our initial focus was on reliable financial reporting. In the coming years this focus will be extended to control over non-financial reporting and business objectives.

Behaviour in line with our Action values is at the heart of our system. Our management across the organisation leads by example, articulating and demonstrating the importance of integrity and ethical values.

Action applies the ‘three lines of defence’ model to manage risk. The first line of defence, operational management, is responsible for identifying, assessing and managing risks and is supported by subject matter experts (second line of defence) originating from Business Control, Risk Assurance or other functions, to facilitate and monitor the implementation of effective risk management practices. Our internal audit function is the third line of defence, providing insights and assurance according to the IIA standards.

Based on a robust review of the risks that we face in achieving our objectives, risks reported by business areas are aggregated at company level and serve as a basis to determine risk management priorities and coordinated risk responses. The implementation of adequate risk responses is monitored by our Risk and Compliance Committee.

To achieve our international expansion objectives, Action is strategically prepared to take risks in a responsible way considering the interests of all our key stakeholders. From an operational perspective, Action takes a cautious approach to risk; everything we do is designed to deliver value to our customers, by offering quality products at low prices. This requires dedication to safety and transparency regarding our customers and delivering articles responsibly produced in line with our sustainability ambitions. Providing customer value takes priority over any other objective. As Action sells its products in an increasing number of European markets and sources these products from various countries across the globe, we need to comply with and take into consideration a growing number of laws, rules and regulations. Action is committed to compliance with these laws, rules and regulations and strives to prevent significant incidents of non-compliance wherever we operate.

We have reviewed the risks that we believe could adversely impact the achievement of our strategic and operational objectives, reputation or performance. Risks are owned and managed by operational management and discussed and monitored throughout the year to identify changes in the risk landscape. Each risk is assessed on likelihood and impact, considering current and expected internal control measures and performance, and assigned to a principal risk category. An overview of the principal risk categories and actions taken is included in a table:

Compared to 2020, the principal risk categories slightly changed. One new risk category is added - sustainability. Additionally, the relative importance of individual risks changed. As a result, we see an increasing risk profile with respect to our brand and customer proposition, end-to-end supply chain and our ability to attract, motivate and retain people, and a decreasing risk profile with respect to third-party management. In all other areas where we are impacted, the risk profile remained comparable as our risk mitigation activities are balanced with the growth and increasing complexity of our company.

As of 2020, the COVID-19 pandemic has impacted the global economy including Action. During 2021 this still had a large influence on our activities in all our countries of operation. We kept our focus on creating a safe working environment for our employees, a safe shopping environment – including digital shopping opportunities – for our customers and playing our part in helping society. The consequence of COVID-19 became mainly visible in our supply chain area, mainly concerning the availability of our product portfolio.

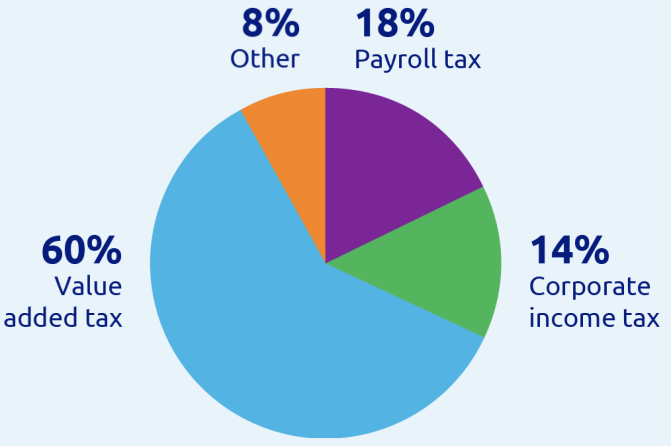

Action believes a responsible approach to tax is an integral aspect of doing business. We see the fulfilment of our tax obligations as part of creating long-term value for all stakeholders. We also consider paying taxes a way of making a positive impact in the communities where we operate. By paying our share of taxes, we contribute to economic and social development in the countries where we operate.

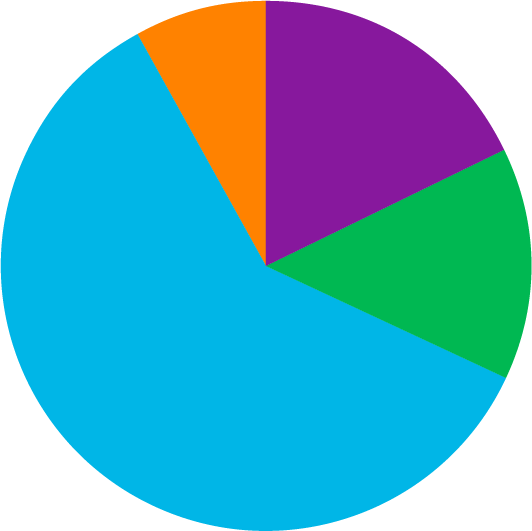

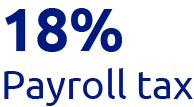

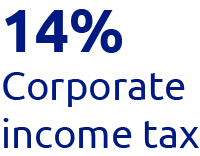

In 2021, Action collected and paid approximately € 1.2 billion of various taxes.

We have a tax policy that consists of five main tax principles: governance, tax risk management, compliance, relationships with tax authorities and business rationale. This tax policy applies to all taxes and to all employees of Action who are dealing with tax matters.

Action believes a responsible approach to tax is an integral aspect of doing business. We see the fulfilment of our tax obligations as part of creating long-term value for all stakeholders. We also consider paying taxes a way of making a positive impact in the communities where we operate. By paying our share of taxes, we contribute to economic and social development in the countries where we operate.

In 2021, Action collected and paid approximately € 1.2 billion of various taxes.

We have a tax policy that consists of five main tax principles: governance, tax risk management, compliance, relationships with tax authorities and business rationale. This tax policy applies to all taxes and to all employees of Action who are dealing with tax matters.

Compared to 2020, the principal risk categories slightly changed. One new risk category is added - sustainability. Additionally, the relative importance of individual risks changed. As a result, we see an increasing risk profile with respect to our brand and customer proposition, end-to-end supply chain and our ability to attract, motivate and retain people, and a decreasing risk profile with respect to third-party management. In all other areas where we are impacted, the risk profile remained comparable as our risk mitigation activities are balanced with the growth and increasing complexity of our company.

As of 2020, the COVID-19 pandemic has impacted the global economy including Action. During 2021 this still had a large influence on our activities in all our countries of operation. We kept our focus on creating a safe working environment for our employees, a safe shopping environment – including digital shopping opportunities – for our customers and playing our part in helping society. The consequence of COVID-19 became mainly visible in our supply chain area, mainly concerning the availability of our product portfolio.

We have reviewed the risks that we believe could adversely impact the achievement of our strategic and operational objectives, reputation or performance. Risks are owned and managed by operational management and discussed and monitored throughout the year to identify changes in the risk landscape. Each risk is assessed on likelihood and impact, considering current and expected internal control measures and performance, and assigned to a principal risk category. An overview of the principal risk categories and actions taken is included in a table:

To achieve our international expansion objectives, Action is strategically prepared to take risks in a responsible way considering the interests of all our key stakeholders. From an operational perspective, Action takes a cautious approach to risk; everything we do is designed to deliver value to our customers, by offering quality products at low prices. This requires dedication to safety and transparency regarding our customers and delivering articles responsibly produced in line with our sustainability ambitions. Providing customer value takes priority over any other objective. As Action sells its products in an increasing number of European markets and sources these products from various countries across the globe, we need to comply with and take into consideration a growing number of laws, rules and regulations. Action is committed to compliance with these laws, rules and regulations and strives to prevent significant incidents of non-compliance wherever we operate.

Action applies the ‘three lines of defence’ model to manage risk. The first line of defence, operational management, is responsible for identifying, assessing and managing risks and is supported by subject matter experts (second line of defence) originating from Business Control, Risk Assurance or other functions, to facilitate and monitor the implementation of effective risk management practices. Our internal audit function is the third line of defence, providing insights and assurance according to the IIA standards.

Based on a robust review of the risks that we face in achieving our objectives, risks reported by business areas are aggregated at company level and serve as a basis to determine risk management priorities and coordinated risk responses. The implementation of adequate risk responses is monitored by our Risk and Compliance Committee.

We monitor our internal control performance by means of internal control activities in the first line, risk and control self-assessments, risk management reviews, and internal audit activities. Dashboards are available for our business teams to allow for online real-time insight in control performance, for example, to monitor self-assessments or the quality of our data processing activities. Taking ownership of internal control and financial performance is formalised by means of our quarterly certification process in which a Letter of Representation is signed by management of selected Action entities.

Quarterly Risk Assurance reports are submitted to and discussed with our business teams, Executive Board, Risk and Compliance Committee and Audit Committee. These reports provide a comprehensive overview of internal control performance and help identifying our improvement potential.

We strongly believe that managing risk in a professional manner is essential to achieving our strategic and operational objectives, while ensuring compliance with internal and external requirements. Our proactive approach to risk management, embedded in our processes, aims to protect and preserve long-term value.

Over the last six years we have implemented a formal risk management and internal control system, based on the COSO Internal Control Framework. Our initial focus was on reliable financial reporting. In the coming years this focus will be extended to control over non-financial reporting and business objectives.

Behaviour in line with our Action values is at the heart of our system. Our management across the organisation leads by example, articulating and demonstrating the importance of integrity and ethical values.

Over 80% of Action’s shares are owned by 3i Group plc and funds managed by 3i, a FTSE 100 firm with operations across Europe and North America. Action has a one-tier governance structure with a Board of Directors, consisting of our CEO and our CFO as executive directors and six non-executive directors. Our current non-executive directors are Simon Borrows (board chair), Menno Antal, Marc van Gelder, Robert van Goethem, Boris Kawohl, Sameer Narang and Ulrich Wolters. An Audit Committee and a Selection, Nomination and Remuneration Committee have been established as sub-committees of the board.

In November 2021, the Board of Directors announced that CEO Sander van der Laan would be succeeded by Hajir Hajji as of January 2022. Simon Borrows, Chairman stated that: “On behalf of the Board I want to recognise and thank Sander for successfully leading the company. Action has continued its strong growth despite the uncertainties presented by the pandemic. He leaves the business performing strongly and on track to deliver its business plan. He has been a driven and committed colleague.”

On Hajir’s appointment, Simon Borrows stated that: “Hajir is a strong leader and has great retail expertise, including on digital and sustainable growth. A longstanding Action executive and an advocate of the Action culture and values, she will bring both continuity and a new push for Action’s next phase of growth. I look forward to working with her.”

Our teams at the international headquarters develop and share expertise across different fields, including HR, IT, Legal, Finance, Marketing and Communications. Our buying team is active globally. Our country offices are primarily focused on store operations and support the stores with the acquisition and construction of new stores and HR services.

Action’s executive directors, our CEO and CFO, are responsible for the day-to-day management of the company and together form the Executive Board. They lead by example with respect to managing risk and ensuring compliance with laws, regulations and our internal policies. They are responsible for ensuring that effective internal control and risk management systems are in place. The Executive Board has established a Risk and Compliance Committee to oversee and monitor Action’s risk profile and associated risk management and compliance policies and processes. The Executive Board is assisted and supported in carrying out their duties and responsibilities by an executive committee consisting of 16 senior leaders responsible for the key functions in our company.

The way we manage our business is in line with our formula: simple and straightforward, with clear demarcations on what is done centrally and what is done within the country offices. At our international headquarters in Zwaagdijk (the Netherlands), a team of professionals works to support the ten country offices in the execution of our expansion strategy.

‘Hajir is a significant part of the Action DNA. Action is ready for the next phase of its growth agenda with an increased focus on digital and sustainable growth, two areas for which Hajir is currently responsible.’ Simon Borrows, board chair

Every day Action